At right is a table that reveals rising chip costs with increases in production. For example, $1,650,000 is spent when 150,000 units are produced (150,000 X $11). Once you incur a fixed cost, it does not change within a given range. For example, Pat can take up to five people in one car, so the cost of the car is fixed for up to five people. The condo rental and the gasoline expenses would also be considered fixed costs, because they are not going to change in the reference range. The graph shows that mixed costs are typically both fixed and linear in nature.

Great! Hit “Submit” and an Advisor Will Send You the Guide Shortly.

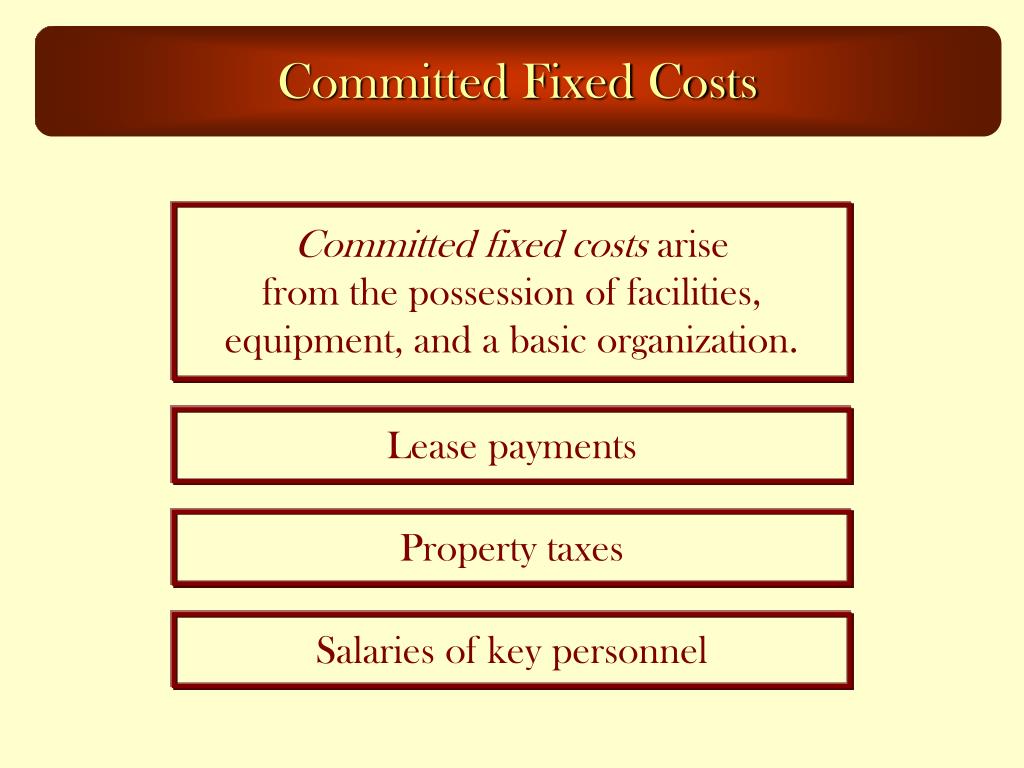

In summary, committed costs are fixed financial obligations that a company has agreed to pay over a period. These costs are crucial for financial planning, risk management, and strategic decision-making. Proper management and understanding of committed costs can lead to better financial stability and efficient operations. Thus, while these costs can be eliminated in the short run at the discretion of management, eliminating them over a longer term can negatively impact the entity and its profitability.

Where should we send your answer?

The company now incurs a lower cost per unit and generates a higher profit. The company’s manufacturing overhead costs tend to fluctuate from one month to the next, and management would like an accurate estimate of these costs for planning and decision-making purposes. Operating costs are day-to-day expenses, but are classified separately can i deduct back taxes paid from indirect costs – i.e., costs tied to actual production. Investors can calculate a company’s operating expense ratio, which shows how efficient a company is in using its costs to generate sales. Managerial accounting methods provide techniques for evaluating the viability and ability to grow or “scale” a business.

Submit to get your question answered.

- The lease payment is considered a fixed cost as it remains unchanged.

- Cost 2 is a fixed cost because as the number of units produced changes, total costs remain the same and per unit costs change.

- As long as the relevant range is clearly identified, most companies can reasonably use the linearity assumption to estimate costs.

- A subsequent chapter shows how to calculate economic order quantities that take into account carrying and ordering costs in balancing these important considerations.

- Thus she determined that a sales level of 6,000 units was still within the relevant range.

- The contribution margin income statement shown in panel B of Figure 2.7 “Traditional and Contribution Margin Income Statements for Bikes Unlimited” clearly indicates which costs are variable and which are fixed.

Unlike committed costs, discretionary fixed costs tend to change over time. Furthermore, committed fixed costs are often considered essential for the long-term sustainability and growth of a business. They represent investments in the infrastructure and resources necessary for the business to operate efficiently and effectively. While these costs may not directly contribute to revenue generation, they are crucial for maintaining the overall operations and reputation of the business. Although this is probably a more accurate description of how variable costs actually behave for most companies, it is much simpler to describe and estimate costs if you assume they are linear. As long as the relevant range is clearly identified, most companies can reasonably use the linearity assumption to estimate costs.

The Company

Because these types of step costs can be adjusted quickly and often, they are often still treated as variable costs for planning purposes. Costs that fall into this category are not ones that can be permanently eliminated. Instead, they are usually expenses that are temporarily reduced or set aside to help with the short-term bottom line. Over time, however, eliminating discretionary fixed costs can hurt your business in a variety of ways, ranging from reduced brand exposure to undertrained employees to reduced research and development outputs. Your company should always leave room in the budget for discretionary fixed expenses for this reason. Total variable costs are costs that vary with production, and they are also called direct costs.

Committed vs Discretionary Fixed Cost

For example, the $380,000 in production costs incurred in April may be higher than normal because several production machines broke down resulting in costly repairs. Or perhaps several key employees left the company, resulting in higher than normal labor costs for the month because the remaining employees were paid overtime. Cost accountants will often throw out the high and low points for this reason and use the next highest and lowest points to perform this analysis. This means that certain efficiencies are achieved as production levels rise. Fixed costs can be spread over larger production runs, and this causes a decrease in the per unit fixed cost.

Say, for example, that your company’s leadership thought that a proposed offering showed immense promise, and $50,000 was allocated to advertising to target clients. However, once the campaign was completed, there was no movement from new or current clients to adopt the service. The sales team was unable to convince customers to sign on, and the service was therefore scrapped from the offerings list.

It is possible that both the selling and administrative costs and materials costs have both fixed and variable components. As a result, it may be necessary to analyze some fixed costs together with some variable costs. Ultimately, businesses strategically group costs in order to make them more useful for decision-making and planning. Two of the broadest and most common grouping of costs are product costs and period costs. A cost that changes with the level of activity but is not linear is classified as a stepped cost. Step costs remain constant at a fixed amount over a range of activity.

As Figure 6.26 shows, the variable cost per unit (per T-shirt) does not change as the number of T-shirts produced increases or decreases. However, the variable costs change in total as the number of units produced increases or decreases. In short, total variable costs rise and fall as the level of activity (the cost driver) rises and falls.

Tony’s information illustrates that, despite the unchanging fixed cost of rent, as the level of activity increases, the per-unit fixed cost falls. In other words, fixed costs remain fixed in total but can increase or decrease on a per-unit basis. A fixed cost is an unavoidable operating expense that does not change in total over the short term, even if a business experiences variation in its level of activity.